Fintech Solutions

Help you drive business growth and streamline your financial operations through AI-powered innovation, customized to position your business to be the forefront of fintech industry.

Our Expertise in Fintech Software Development Solutions

Working with current and legacy systems, established infrastructure, and compliance standards, we deliver fintech software solutions for tech firms.

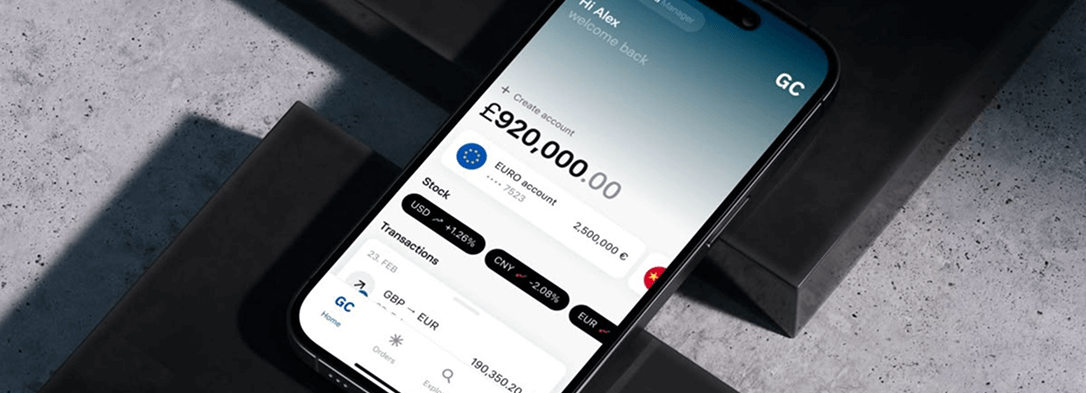

Mobile wallet apps

Build secure, user-friendly digital wallets that enable instant payments, fund transfers, and transaction tracking.

Payment Gateways and Payment Processing

Develop robust payment systems that ensure seamless, compliant, and multi-currency transactions.

Wealth Management

Create smart portfolio management platforms that automate investing and enhance financial decision-making.

Insurtech

Deliver digital insurance solutions that streamline claims, policy management, and customer engagement.

Legacy System Integration

Modernize outdated infrastructure by integrating new fintech tools with existing banking systems.

Omnichannel Payments

Enable consistent payment experiences across mobile, web, and in-store platforms.

Personal Finance Apps

Design intuitive tools that help users budget, track spending, and reach financial goals.

Financial Data Aggregation & Analytics

Implement AI-driven systems that unify financial data and deliver actionable insights for smarter decisions.

How we empower financial business through technologies

Organizations are using new technologies to become more agile and less limited as we approach a new era of financial transformation.

The creation of a certain kind of software application intended to digitalize financial services and goods for B2B, B2C, and P2P markets is known as fintech app development services.

In addition to including your preferred features, the app must provide users with cutting-edge digital finance solutions that increase quantifiable company value.

At Adamo Australia, we aim to lead in innovative fintech solutions, empowering financial firms through transformation with cutting-edge technology, user-centric design, and deep industry expertise.

Technologies used for

Fintech Solutions Development

Our expert development teams apply modern automation, security, and data protection practices to deliver smarter, more secure, and scalable digital financial experiences.

Cloud Computing

for scalability and operational flexibility

Advanced Data Analytics

to support data-driven decision-making

AI & Machine Learning

to automate processes and enhance intelligence

Robotic Process Automation (RPA)

to improve efficiency and reduce manual effort

Blockchain

for secure, transparent transactions

API Integration

for seamless system connectivity

IoT

for real-time data monitoring and insights

Biometric Authentication

for stronger identity verification and security

Explore our Fintech Development Offerings

We bring innovative fintech software development teams to you, with industry expertise in security, compliance, and regulations across our services.

Build, scale, succeed with expert partners on your side

We turn ideas into market-winning digital products.

Learn More

Learn More

-

Web

-

F&B

-

AI

Global AI-Integrated CRM System for Restaurant Networks

Designed and developed by Adamo Software, this solution integrates advanced AI-driven recommendation directly into CRM operations, helping restaurant brands across multiple countries deliver personalized campaigns at scale.

Learn More

Learn More

-

F&B

-

AI

Hungry Hungry

This project focuses on scalable F&B digital transformation through deep POS integrations and optimized system performance to support long-term growth.

Learn More

Learn More

-

Web

-

Travel & Hospitality

Freelance Travel

The solution enables faster tour creation, higher user retention, and a scalable foundation for future AI-powered travel recommendations and automation.

Learn More

Learn More

-

Mobile

-

Social Media

-

AI

Krunk

This project focuses on digital transformation in social fitness through an intelligent, community-driven mobile application.

Learn More

Learn More

-

Web

-

Healthcare

-

AI

Sydney Bariatric Clinic

Partnering with Adamo AU, SBC aimed to redefine their digital presence though a redesigned website that reflects the clinic’s commitment to high-quality heathcare services.

Learn More

Learn More

-

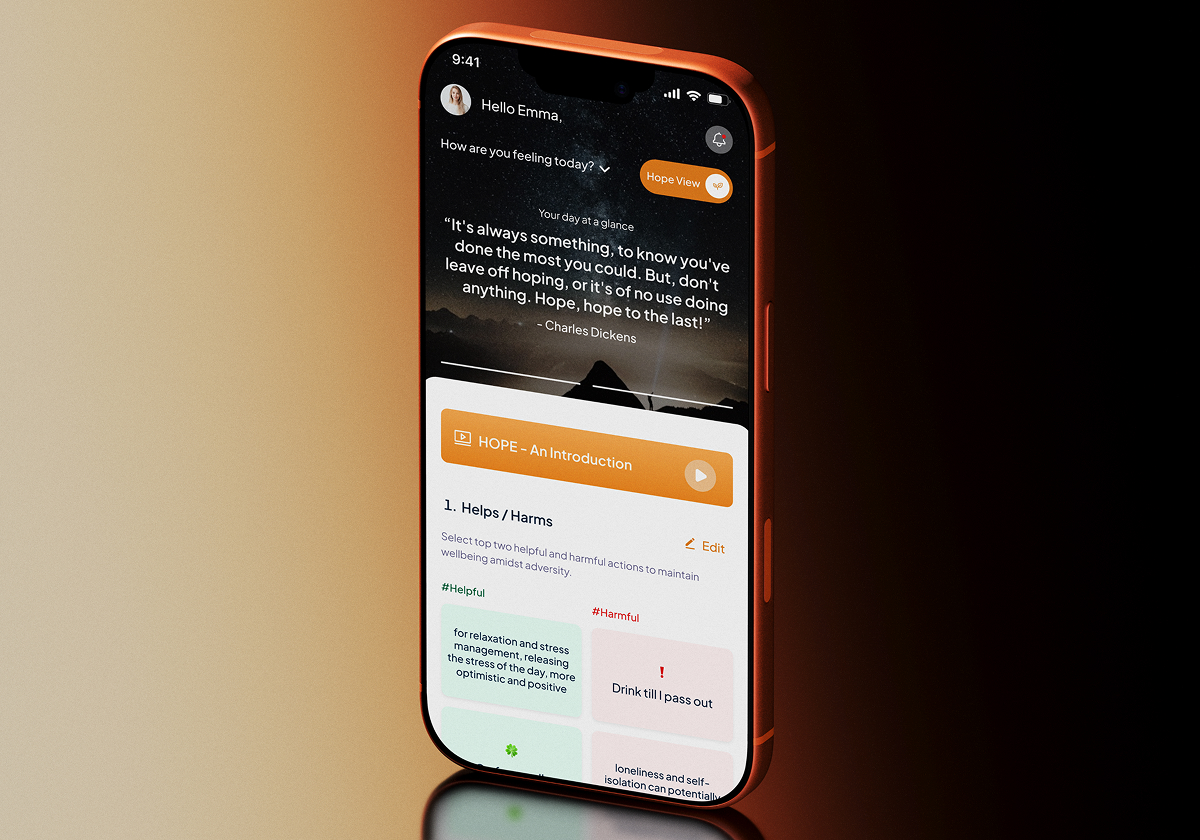

Mobile

-

Healthcare

Safe Guide Life

Teaming up with Adamo, Safe Guide Life turns proven therapy into an easy-to-use app, bringing hope and support to everyone through a smooth platform.

Frequently Asked Questions

How do custom Fintech solutions support compliance with Australian financial regulations?

Custom FinTech solutions are built with compliance in mind, enabling alignment with Australian regulatory requirements such as data security, auditability, and risk controls. This approach helps financial institutions and startups meet compliance obligations while maintaining flexibility and innovation.

What core features are essential for building scalable Fintech platforms in Australia?

Scalable FinTech platforms require secure transaction processing, robust APIs, real-time data handling, and modular architecture. For Australian FinTech businesses, scalability ensures the platform can handle user growth, new financial products, and evolving regulatory demands.

Why do Australian Fintech companies choose custom development over off-the-shelf solutions?

Australian FinTech companies choose custom development to gain greater control over security, integrations, and product differentiation. Custom solutions allow businesses to innovate faster, adapt to regulatory changes, and scale without the limitations of generic platforms.